Table of Contents

Introduction

The Chief Minister of West Bengal, Ms. Mamata Banerjee has launched the student credit card scheme on Wednesday that is 30th June 2021. This was described as the biggest project that has been ever launched by the West Bengal government. Financially, students will not have to worry about their admission to higher Ph.D. or other expensive degree fees. It is said that the total amount one can get from it is around 10 lakhs.

The Advantages of Student Credit Card

- Using this card, any student from class X onwards can apply for loans in any place with the least interest.

- Students will be able to take admission in coaching centers and can also sit for competitive exams using this card.

- Not only from west Bengal but people can also study at foreign universities using this card for courses ranging from engineering to honors up to doctorate or post-doctorate level.

- Each student can avail of a loan of at least 10 lakhs. This loan can be taken at one go or at several intervals.

- The education loans given from banks will be easier via this card and there will be no additional collateral security with the loan.

- The interest rate will be only 4% and if the loan is cleared within the study period then there will be a rebate of 1%

- Various institutional and non-institutional expenses will be covered in this loan through the student credit card.

Eligibility Criteria

- Has to be a permanent resident of West Bengal

- Must be living here for more than 10 years

- Must be a resident of West Bengal for 40 years

- Must be in class X

- Have enrolled in the desired course

Documents Needed

- Adhar card

- Residence certificate

- Age proof

- Ration card

- Income certificate

- Bank account details

- Mobile number

- Passport-sized photo

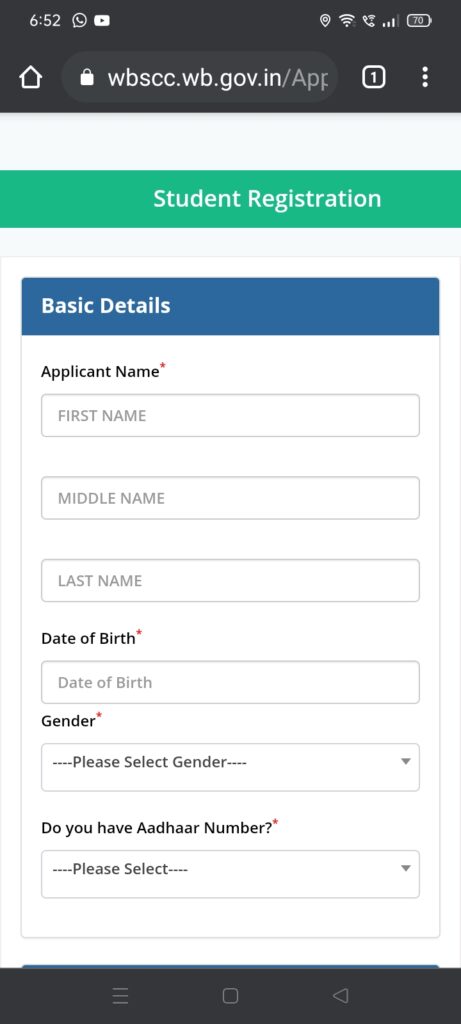

To get a hold of the student credit card, one needs to apply online. Here’s to how you will be able to do it.

How to Apply for Student Credit Card

- Go to https://wbscc.wb.gov.in/

- To register for a credit card click on student registration

- A page will be filled in where you will be required to fill in the basic details

- You can select your date of birth from the drop-down menu

- Fill in with the correct aadhar card number

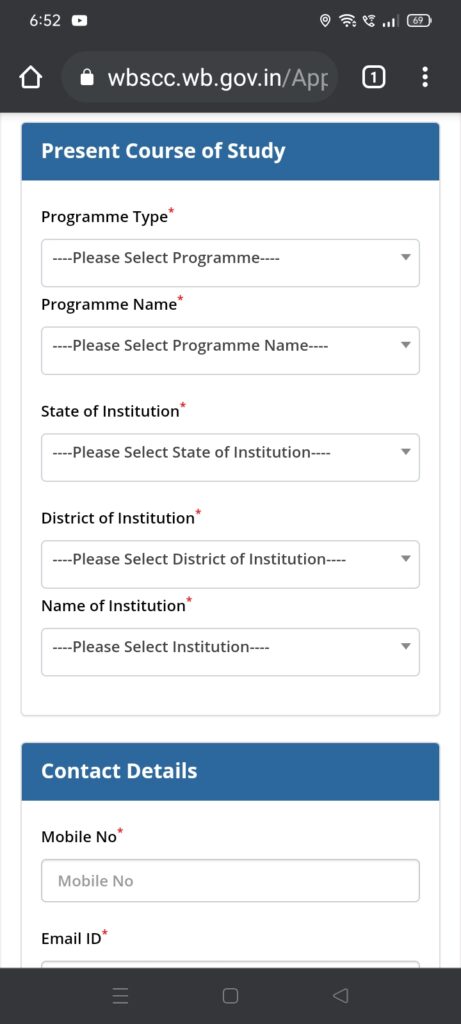

- Add your present course of study details

- Fill in with the details of the course and institution.

- Only available when you have the admission letter available

- Search which coaches are available and that will decide if you are eligible for the loan or not

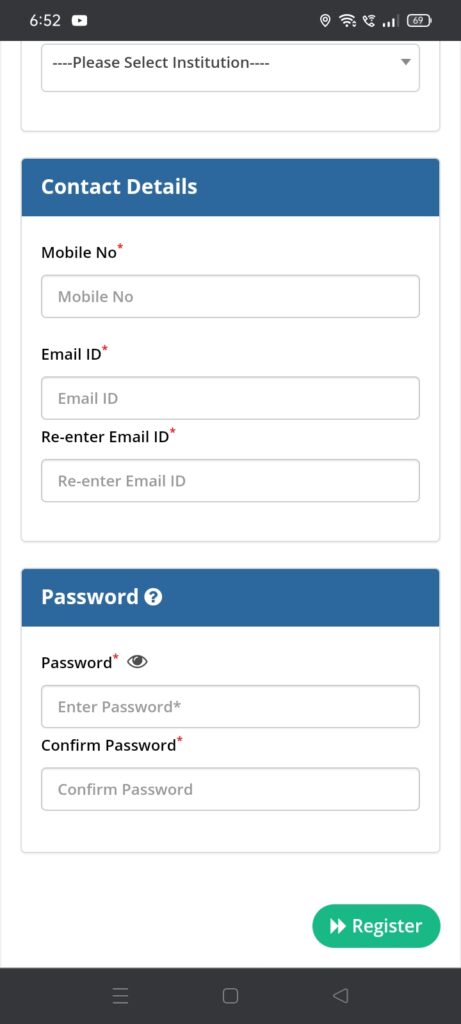

- Fill in with your contact details

- You will be sent an OTP and you have to create a password

- Enter the OTP in the given space and click on verify

- After your verification is done, you will be notified with a pop-up window where it will be written that your registration is successful.

- You will be provided with a registration ID and your login credentials will be sent off to your phone for you to log into it.

- Return to the website and go to student login

- Sign in with your registration ID and password. You will be required to write a verification number each time you log in. The number can either be sent to your phone or displayed on the signup page.

- Click on login and you will be able to access your account

After Logging in

- You will see a page where it will be written, “West Bengal Student Credit Card”

- There is a logout option for you to use as well

- Your activity status will be shown

- Application registration will be shown as done

- Application form fill up will be shown as pending

- You need to also upload necessary documents to that portal

- The application submission tab will be showing pending until everything is over

- Your status will change according to what actions you do.

- Click on apply now and you will be needed to fill in the required additional details as to your

father’s name or your legal guardian’s name. - Mention the relationship you have with the person whose name you have given.

- Write your pan number in the necessary slot

- Enter the co-borrower details and add your guardian’s contact number

- Mention both your and your co borrower’s gender

- Add your present address

- If you have received any scholarship click on yes and continue with filling in.

- Mention the scholarship id number if received any

- Add your course fees and tuition fees with solid proof

- Mention the loan amount

- Provide the IFSC code and bank account number with bank name

- Select the bank from which you want to take a loan from including its branch

- Click on save and continue and sign on the declaration

- Add the necessary documents

- If all goes well and your documents are approved, then your student loan will be approved.

Here are some relevant screenshots.

Conclusion

Student online credit card is a wonderful scheme organized by the West Bengal government. The main objective of this initiative is to provide loans to students for higher education. The financial burden will be reduced and they can study without worrying much about the money. Each student will be able to get assured education and with this, the unemployment rate will decrease as well.

Also, Read | How to install Windows 11

Also Read | Best Gaming Monitors under 10000 to buy in India (2021)

Follow Us on Google News to Stay Updated

FAQs

It will be a PVC card that looks the same as normal credit cards given to bank

Yes it can be applied by both CA and CMA students

Yes this is available for them as well

That is not possible and you will be given loan based on the education details you give.

Yes

You can click on the no option where you are asked if you pan card or not. You will be asked to sign an alternative document where you agree you don’t have a pan card but you will abide by the rules provided.